Are you prepared for Minnesota’s Paid Family & Medical Leave (PFML) Program?

As your HR partner, we’re here to help you navigate Minnesota’s new Paid Family and Medical Leave (PFML) program. This state-mandated benefit will impact nearly every employer in Minnesota, and proactive planning is essential to ensure compliance and minimize disruption.

What Is PFML?

Effective January 1, 2026

Minnesota’s PFML program provides eligible employees with up to 20 weeks of job-protected leave per year with partial wage replacement for qualifying family and medical reasons. Benefits begin January 1, 2026, and employers must begin payroll deductions on January 1, 2026.

Key Employer Responsibilities

Premium Contributions

2026 rate: 0.88% of wages, split between employer and employee

Employers must cover at least 50% of the premium

Small employers (≤30 employees, lower average wages) may qualify for reduced rates

Leave Administration

Employees apply directly to the state for benefits

Employers must coordinate PFML with existing leave policies (e.g., PTO, FMLA, short-term disability)

Employee Communication

By December 1, 2025: Post PFML notice and provide individualized written notices to all employees

New hires must receive PFML notice within 30 days of hire

Payroll Setup

Configure systems for wage reporting and premium deductions

First premium payment due April 30, 2026, covering Q1 wages

Let’s make this transition seamless.

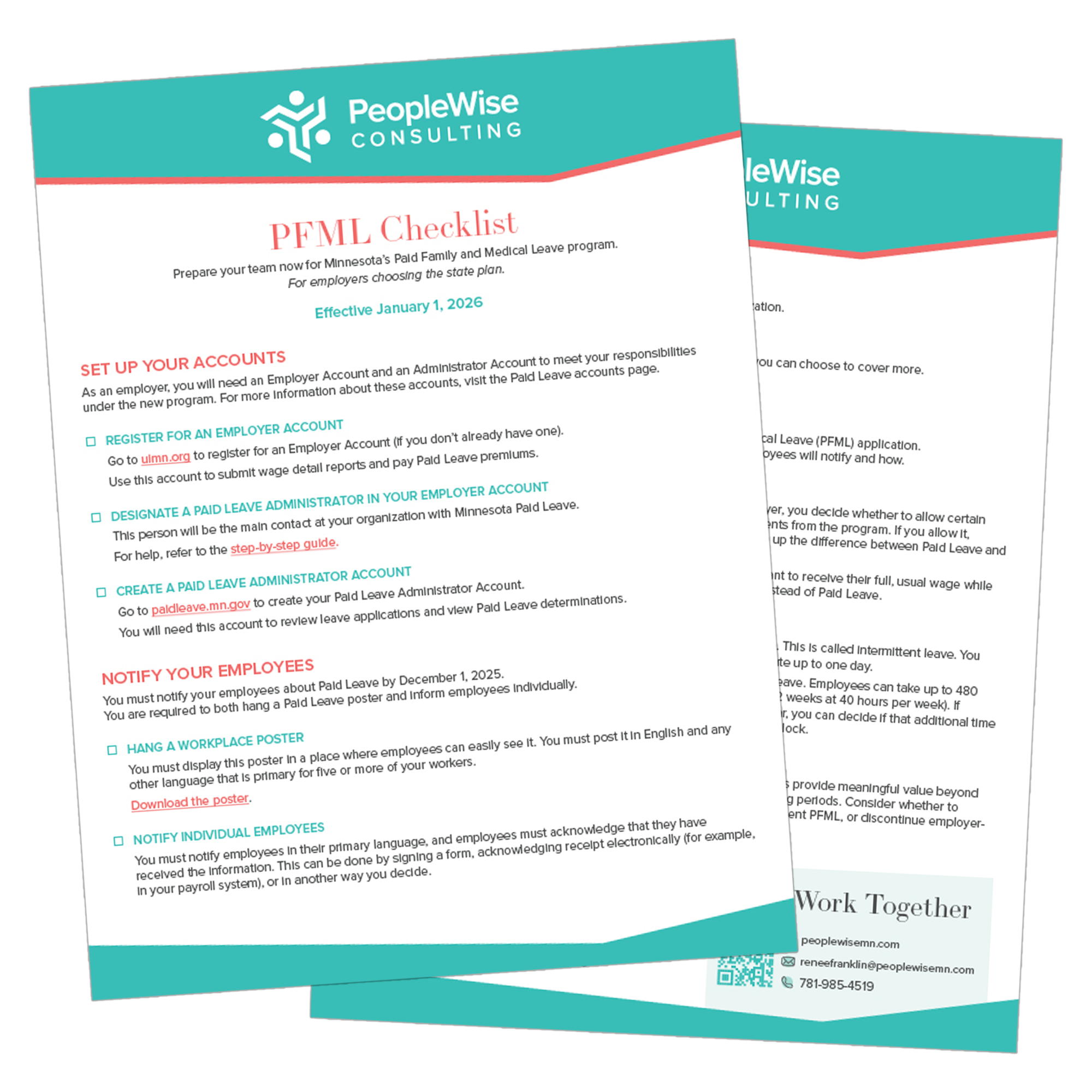

Prepare your team now for Minnesota’s Paid Family and Medical Leave program. Our PFML Readiness Checklist walks you through the essentials so you can update policies, align payroll and benefits, and communicate confidently with employees.

Download the free checklist to stay ahead of the changes and avoid last-minute scramble.

How PeopleWise Consulting Can Help

We’re here to support you through every step of PFML implementation:

Strategic Planning

Help evaluate whether a private plan is right for your business

Support budgeting and forecasting for premium costs

Policy Review & Integration

Align PFML with your current PTO and leave policies

Update employee handbooks and internal documentation

Payroll & Compliance Setup

Configure payroll systems for premium deductions

Ensure wage reporting is aligned with state requirements

Employee Communication & Training

Provide templates for required notices

Assist with onboarding materials and workplace postings